|

| Kaufman |

|

| Kaufman |

|

| Kaufman |

|

| Kaufman |

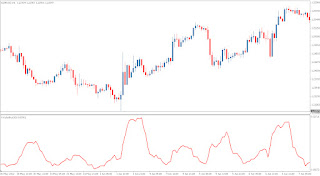

Kaufman Volatility Indicator developed by Perry Kaufman. Perry Kaufman this indicator described in more detail in his book Trading Systems & Methods and Smarter Trading. Kaufman Volatility Is the indicator that measures market volatility, its span. It is appropriate to combine this with a trend indicator or volume indicators, such as

Moving Average,

Bollinger Bands,

METRO,

Ichimoku Kinko Hyo, etc.

Kaufman Volatility Indicator MQ4 Code Base (Copy Code)

//+--------------------------------------------------------------------------------------------------+

//| b_Kaufman_Volatility.mq4 |

//| Copyright © 2011, barmenteros |

//| http://www.mql4.com/users/barmenteros |

//+--------------------------------------------------------------------------------------------------+

#property copyright "barmenteros"

#property link "barmenteros.fx@gmail.com"

#property indicator_separate_window

#property indicator_buffers 1

#property indicator_color1 Red

// ---- inputs

// ERperiod It should be >0. If not it will be autoset to default value

// histogram [true] - histogram style on; [false] - histogram style off

extern int ERperiod =10; // Efficiency ratio period

extern bool histogram =false; // Histogram switch

extern int shift =0; // Sets offset

// ---- buffers

double KVBfr[];

// ---- global variables

double noise;

//+--------------------------------------------------------------------------------------------------+

//| Custom indicator initialization function |

//+--------------------------------------------------------------------------------------------------+

int init()

{

string short_name;

// ---- checking inputs

if(ERperiod<=0)

{

ERperiod=10;

Alert("ERperiod readjusted");

}

// ---- drawing settings

if(!histogram) SetIndexStyle(0,DRAW_LINE);

else SetIndexStyle(0,DRAW_HISTOGRAM);

SetIndexLabel(0,"KVolatility");

SetIndexShift(0,shift);

IndicatorDigits(MarketInfo(Symbol(),MODE_DIGITS));

short_name="KVolatility(";

IndicatorShortName(short_name+ERperiod+")");

// ---- mapping

SetIndexBuffer(0,KVBfr);

// ---- done

return(0);

}

//+--------------------------------------------------------------------------------------------------+

//| Custom indicator iteration function |

//+--------------------------------------------------------------------------------------------------+

int start()

{

// ---- optimization

if(Bars<ERperiod+2) return(0);

int counted_bars=IndicatorCounted(),

limit, maxbar,

i;

if(counted_bars<0) return(-1);

if(counted_bars>0) counted_bars--;

limit=Bars-counted_bars-1;

maxbar=Bars-1-ERperiod;

if(limit>maxbar) limit=maxbar;

// ---- main cycle

for(i=limit; i>=0; i--)

{

noise=Volatility(i);

if(noise==EMPTY_VALUE) continue;

KVBfr[i]=noise;

}

// ----

return(0);

}

double Volatility(int initialbar)

{

if(initialbar>Bars-ERperiod-1) return(EMPTY_VALUE);

int j;

double v=0.0;

for(j=0; j<ERperiod; j++)

v+=MathAbs(Close[initialbar+j]-Close[initialbar+1+j]);

return(v);

}